First published in BC Business Magazine

There was a telling scene at an auction I attended recently. It was the Modern Woman show at Maynards, where the 108-year-old auction house had assembled a group of 35 contemporary fine art works from 24 emerging artists. Unlike the typical Maynards auction of items sourced from estates and other sellers, this show was made up of items selected by newcomer contemporary art specialist Kate Bellringer, a UBC and Sotheby’s Art Institute graduate. And by all appearances, the new show and the new approach looked set to be a smash success. A good-sized crowd had turned out, 60 or 70 people, milling around and sipping pinot gris and Pellegrino water. And while it was a younger crowd than normally came out to auctions, according to Maynards’ VP of fine art and antiques Hugh Bulmer, who also acts as chief auctioneer, it was clearly a fashionable and affluent group, with Manolo Blahniks and Prada frames sprinkled liberally through the crowd. The room looked ready to buy some art, in other words. And the hip work Bellringer had chosen seemed well suited to the audience.

Only the crowd wasn’t buying art.

Or not with much confidence, anyway. Bids were sparse and hesitant. Only a single item in the first 17 lots sold at even the bottom of the estimated price range, with most selling for less than half that minimum and many of these on a single uncontested bid. The telling scene finally came about just following the sale of a beautiful oil-on-canvas piece by Roselina Hung, Saint Germaine de Pres. True to the evening’s form, Hung’s piece sold for $1,000 on a single bid, after Bulmer had dropped the price twice to less than half of its minimum estimated value of $2,400, which had provoked the auctioneer to mutter sotto voce in his ironic British style: “Well that certainly was a good buy.” And after three subsequent lots had sold at fractions of their estimated value with no competitive bidding, Bulmer finally stopped the whole auction in its tracks.

“Can I just ask something?” he said, removing his glasses, and speaking with the tested patience of a parent addressing a child over homework. “How many people here have been to an auction before?”

Bulmer played it for laughs and people obliged, particularly when he followed up with a quip to the effect that we shouldn’t let auctions intimidate us as they were a great place to meet people and, you never know, “you might find yourself going home with something you like.” But as the auction proceeded, and bidding did modestly loosen up, his comment seemed to clarify why we’d all been invited to the event. Maynards wanted to showcase emerging talent and sell a few paintings, of course. But sales were never the main objective here – indeed the show grossed only slightly over $20,000 in the end, hardly enough to cover its costs. We were there for the purposes of our own education.

Maynards had staged the Modern Woman show in the hopes of grooming future auction goers.

Which isn’t a new idea, of course. Industries as diverse as recreational skiing and retail banking have been known to target young people with promotions programs and discounts in order to build brand loyalty. What’s different in the antiques and collectibles auction trade at the moment is the sudden imperative to do so, stemming from the fact that audiences in this part of the world have been dwindling.

Part of that is due to disintermediation effects. As web technologies have squeezed out middlemen such as travel agencies and brokerage firms, so too have auction houses been affected. In the area of collectibles, we’ve seen the sale of many categories move online via Craigslist, Ebay and other sites. If you’re in the market for a 1960s chrome Italian floor lamp, or a pristine set of Wacky Packs Series 7, or an Optimus Prime in his original box, you’re going to cover far more ground, far more quickly searching those sites as opposed to auction preview rooms. And that shift doesn’t only apply to lower-priced items, as anybody out there looking for a mint Movado Triple Date wristwatch can tell you.

A second part of this change is driven by fashions that have critically shifted. Back in the day, a significant part of the Maynards business model involved selling Victorian “shipping goods” – that is, Victorian furniture shipped to North America from the UK by the container load. On any given day, even just five years ago, the Maynards showroom – then on 2nd Avenue near the Cambie bridge, now in a larger facility at 2nd and Main – would have been full of hutches and tall boys, Victorian chaises and fainting couches. These were widely in demand to decorate middle-class homes and commanded good prices.

Now, Bulmer says flatly, “nobody wants them.” The older generation has long finished their furniture acquisitions. And the younger generation, decorating condominiums in Yaletown and Southeast False Creek, don’t go for the Victorian style. A long-time auction enthusiast colleague illustrated this perfectly to me describing a solid maple Victorian corner cabinet found at auction this past summer, complete with a packet of letters in a lower drawer from a son back to his Montreal parents during his tour of India in the late 19th century. An extraordinary find for anyone interested in history and fine furniture. Worth several thousand dollars even 10 years ago, my colleague guessed. In 2010, it sold for $100.

But there’s also a third factor, which ultimately may prove the most challenging for bricks-and-mortar auction houses. And that’s the explosive rise in the market for Chinese antiques and collectibles. For decades, Chinese collectibles were sold out of the country via the tourist trade or taken out by other means. Now, a new class of affluent Chinese buyer wants these pieces back. And a new class of Chinese antiquities and collectibles dealer is scouring the world looking for them. Is Vancouver a target city? You can count on it. As Michael Scott, an auction enthusiast and former arts editor at the Vancouver Sun, puts it: “Vancouver is a treasure box.”

The boom in this marketplace has been sharp and dramatic. Over at Maynards, Bulmer describes an antiques and collectibles business model that has been literally turned on its head. Annual sales, now around $3 million in art and collectibles, used to split roughly 90%-10% between goods sourced in Europe and those sources in Asia. That ratio has been inverted in just five years with sales of Chinese pieces replacing what Bulmer describes as the “lackluster” sale of 19th century European furniture. But over the next 12 months, those revenues are likely to rise, as Bulmer says Maynard’s is projecting a “huge surge in this Chinese market”.

The clear risk here, of course, is that the market will also surge past the expertise of auction appraisers, hampering their ability to compete for a piece of the action. And in the opinion of some observers, many traditional auction houses face exactly that threat.

“The people buying are professional dealers from China,” Vancouver auction veteran Constantine Anastasopoulos tells me, who at 70 years of age is a life-long follower of the fine art and collectibles scene. “They know what’s worth what. And the auction houses often don’t.”

Bulmer feels confident that Maynards can compete. THE 57 year old Wales-born auctioneer, who learned his trade with Phillips fine auctioneers in London and arrived in Vancouver 11 years ago, notes that he trained in Chinese antiquities himself so he feels that the skill set is in-house already. But he doesn’t deny that the market today is trading heavily in goods that Maynard’s never paid any attention to previously. “It used to be that collectors of Chinese pieces only wanted the 18th century and earlier,” he says. “Now that a lot of those pieces are in museums and private collections, collectors are looking at areas and pieces that five years ago we wouldn’t have even taken in the door at Maynards.”

And when it comes to trading in pieces from the industrialized age onward, it gets really tricky. “How do you know if this vase produced in a Chinese factory was made at 4,000 pieces a minute or one piece a month?” Anastasopoulos says. “You don’t.”

With that uncertainty in mind, Anastasopoulos recently sold a Chinese room screen for $25,000. He’d bought it 20 years previously at an auction in Ottawa for $10,000. But how did he price the piece today? He put an ad in a Chinese language paper and four days later a dealer from China showed up and bought it on the spot.

“It took him three minutes to decide,” Anastasopoulos remembers, chuckling. “He knew something I didn’t know, right? So I just told him what I paid for it and that I’d trust his judgment and a feeling I had that he wouldn’t take advantage of me. What else could I say? I’m not an expert. I bought it because I liked it. I had no idea what it was worth.”

Anastasopoulos’s story reveals the position that many auction houses find themselves in these days, selling Chinese collectibles into a market that is not familiar to them. As reported in the Vancouver Sun in April this year, Maynards itself was surprised when a Chinese platter it estimated to be worth $2,000 ended up selling at $506,000, making it the most expensive antique they’d ever sold. But that’s not an isolated example. Other people, speaking off the record, told of similar sales at other auction houses: a Chinese scroll selling for $60,000 on an estimate of $50, or a 350-year-old Chinese vase selling for over $100,000 on an estimate of $800. In each of these cases, the buyers were Chinese dealers who clearly had market information that the auction houses didn’t.

That information asymmetry isn’t an immediate financial problem to an auction house. When you’re working on commission and something sells for a hundred times your estimate you may be embarrassed, but you also make a hundred times more money. Longer term however, it spells trouble. If we’ve learned anything from disintermediation it’s that middlemen get squeezed out quickest when they start to impede the flow of information from suppliers to consumers. Why did most of us stop going to travel agents? Because we could get the travel options quicker looking at Expedia or Travelocity. Auction appraisers likewise stop adding value when they can’t pick the masterpiece from the mundane.

And that’s a problem, Anastasopoulos believes, because the market is also full of fakes. Not just auctions. Fakes are everywhere, he stresses. He freely admits being burnt himself in an airport duty free shop where an employee swapped out a real watch for a knock-off, something he only discovered on arriving home, 20,000 miles later. But then he immediately remembers another story, closer to home, where a friend bought a North Face jacket in Whistler only to find out it was a Chinese fake when he sent it in to have the zipper repaired. That’s just the way it is now, Anastasopoulos says. And for auction appraisers, it’s a huge challenge given the wide range of objects they’re called on to appraise. A sword collection from France one minute and a Russian vase the next, pottery from Vietnam and the some African death masks from Gabon.

“Appraisers know more than you do, sure,” Anastasopulos tells me. “But there’s no school in the world that can teach you about all of that. So they wing it.”

Of course that doesn’t mean auction houses will disappear. But it does mean that they will have to seek the arenas in which they can thrive. One of these, as Maynards has clearly sussed, is in contemporary art.

I spoke with David Allison, co-principal of the creative services firm Braun/Allison and a self-described “collector since birth.” Having collected everything from stamps to Cub Scout badges, Allison now collects Danish modern designer Henning Koppel, contemporary art such as the photography of Reece Terrice, as well as old trophies, several of which he has set up on the corner of his desk in his sleek Yaletown office. Allison is a great example of the new-era collector in that his tastes are modern and eclectic, but also in that he buys things both online and in live auctions.

“Ebay is an extension of my childhood collecting problem,” he laughs, referring to the auction site where he sources both the Koppels and the trophies. “But for me there is still some hesitation around buying something at a certain price point from someone you never have and never will meet.”

That’s why, for contemporary art, Allison uses galleries and auctions. Because those are the places where he can source the information to make an informed purchase from curators and appraisers he trusts. So he regularly buys work at the Contemporary Art Auction, as well as at auctions held by Presentation House and the VAG. It was in just such a setting, at an auction at the Western Front, that he first came across Terrice. And having spoken at length with the curator about the artist, and then triumphed in a competitive round of bidding, Allison became the owner of Terrice’s 2005 work American Standard.

Allison’s attentiveness, and the presence of a knowledgeable curator at the auction, resulted in a true win-win-win. The artist and the auction house sold a piece. And Allison had himself a real collectible as Terrice’s star has continued to rise. He’s since had a solo show at the VAG. And American Standard itself is slated for donation to the VAG’s permanent collection. None of which would have been possible without the mediation of an auction.

Which was a thought very much on my mind at a second auction I attended at Maynards, just a couple of weeks after the Modern Woman show. That first show suggested to me that Maynards had its eye on the future, cultivating a new market and new potential clients, and working to maintain its place as a trusted intermediary in a market that still needs its services. But at this second show, it struck me that they were doing more than seeding the ground for future harvest. In this category, they’re already a success. And that category is guns.

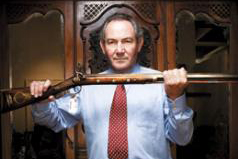

Yes, indeed, in mid-October I attended Maynards third gun auction, now slated as a semi-annual part of their permanent repertoire. And if being an intermediary depends on being the conduit for good information from suppliers to consumers, then here is an area, especially in Canada, where auction houses can thrive. Guns typically come out of estates, Bulmer tells me. And the people inheriting them frequently don’t have the Possession and Acquisitions License necessary to transport or even sell them. Enter the auction house, which can take ownership of the weapons and arrange the transmission of this information to a very avid buying public.

Avid being the key word here. If you’ve recently stood in a roomful of timid people sipping white wine and struggling to raise their bidding palettes for the work of emerging contemporary artists, the gun crowd will strike you as remarkably enthusiastic. The preview was charged with energy, with an assorted range of gun and rifle buffs inspecting the wares and comparing notes. “This weapon,” I heard a bearded man announce to those standing nearby as he hefted a 19th-century English flintlock blunderbuss with a belled brass barrel and a walnut stock, “was intended for killing at extremely close quarters.”

But then there were the young tattooed men in sideways ball caps scoping out the Smith & Wesson and Ruger revolvers. And the gents in natty check jackets cracking open the side-by-side double-barreled Winchester Model 21 shotguns. And a whole different set of collectors down at the far end of the glass counter aiming the 18th-century Boston pocket pistol and sighting down the carved length of the two North African flintlock rifles.

Energy. Enthusiasm. And only a single channel through which it could be directed. Because there was no shop down the street selling Sig Sauer semi-automatic pistols or Winchester lever-action 20-20s. No website either. In Canada, you have to come to places like Maynards. And when I commented to senior Maynards appraiser Neil McAllister that the prices didn’t even seem that high given the robust crowd interest, he only grinned and advised that I should wait for the auction itself.

Which I did, of course, allowing me to see what happens when an intermediary sits between a source of information – physical guns, in this case – and a widely ranging group of people who are prepared to pay for access to it. Bidding, to say the least, did not bear any resemblance to the Modern Woman show. Not everything met its estimated value and one of the 130 lots even went unsold. (No takers, surprisingly, on the Carcano 6.5 mm bolt action rifle despite it being the same weapon Lee Harvey Oswald purchased by mail order to kill John F. Kennedy.) But the interest in everything else was lively, and the bidding reflected that. And even if Bulmer betrayed his disdain on a couple of occasions from the front of the room, referring sarcastically to the matte-black Winchester Defender 12-gauge as “a real gentleman’s gun” or the Ruger .22 rifle equipped with a silencer as “a rather business-like machine,” that didn’t prevent the odd mix of ball caps and tweed jackets from buying up virtually everything in sight. Sixty-thousand dollars’ worth of armament, all gone in a couple of hours. And not once did Bulmer have to stop and ask the crowd if they’d ever done this before.

So the auction house remains and will thrive in the markets where intermediaries are still required. And when I ask Constantine Anastasopoulos about that, he only laughs. “Oh there will always be auction houses. They’re definitely not a dying breed.” There’s a recession going on, he reminds me. And in recessions people want to sell things in a hurry. Auction houses are good for that. “Only remember,” he cautions, “that in today’s world, it’s buyer beware.”

Then he hesitates, this man who’s been around auction houses and collectibles long enough to know what he doesn’t know. He pauses to consider the far-reaching ramifications of the dictum. Then he adds: “Maybe you should end your story on that note, right there: buyer beware.”