For the Globe and Mail’s Report On Business Magazine

Calvin Ayre gained vast riches and notoriety as a gambling mogul, but ended up a fugitive from U.S. law. Now he’s made a big bet on bitcoin, the world’s most explosive cryptocurrency. Will this adventure have a happier ending?

—

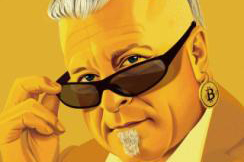

I have to hand it to him. Ten years since the last time I saw him, and he’s the same Calvin Ayre. Does his gym time, I’ll bet; eats well. His eyes are a little bleary, maybe he drinks a few more than his doctor wants. But at 56, he still comes off like a young guy, a rebel, a force of change. He walks into Scott’s in Mayfair—fanciest fish joint in London, unless there’s another place selling Dungarvan oysters for $32 a six-pack. The place is pure London bling, with a tricked-out bar with tiled pillars and a mountain of ice studded with lobsters. There are paparazzi parked out front 24/7, waiting for Ronnie Wood or Elton John, Tamara Ecclestone, Tom Hanks. Scott’s is where Charles Saatchi grabbed Nigella Lawson by the throat a few years back. It’s that kind of posh.

Ayre strolls in wearing torn jeans and a grey T-shirt. His hair is shaved close on the sides, long down the back. Soul patch, glint of mischief in his eyes. The waiters swarm in their sharkskin suits, pulling out chairs and smoothing the tablecloth. They don’t know he’s the most famous son of Lloydminster, Saskatchewan, the only Canadian Prairie export to make the cover of Forbes’s billionaire issue. They’re thinking he’s a star they haven’t yet quite recognized.

“How ya doin’?” Ayre says, a big paw extended for a shake. I feel like I’m meeting up with a favourite eccentric uncle.

Last time I saw him, the mood was strikingly different. We were on the Playa Tambor in Costa Rica, Ayre sitting on an elevated chair, flanked by sullen models, watching a mixed martial arts tournament. He was an online gambling mogul back then. His Costa Rica–based website, Bodog.com, which he wholly owned, had revenues of more than $7 billion (all values in U.S. dollars unless otherwise indicated). Ayre had a mansion outside San José and a penthouse apartment in Vancouver worth $6.2 million (Canadian) at the time, easily double that today.

But there was also a distinctly dark air about the man back then. Bodog’s money was coming almost entirely from American gamblers, which put Ayre on the far wrong side of U.S. law. He wasn’t yet a fugitive from the Department of Justice, but he told me he was about to flee Costa Rica for extradition-proof Antigua. And the whole atmos-phere of our meeting had an end-times edge. All those fighters standing around flexing their muscles, girls in Brazilian bikinis smoothing lotion on one another’s shoulders. When I went to his mansion later, I was buzzed in at the front gate by security hiding behind one-way glass. I passed through the abandoned courtyards; the pool, with its swim-up bar; the barbecue pit; the outdoor gym. I found Ayre being photographed in a back room, spread out in a suit on a bed covered in red satin alongside a model in lingerie. Scarface came to mind, the final act. And when we spoke in his office afterwards, he was gruff, referred to the press as pigs, didn’t look me in the eye once, leaving that job to his framed portrait, unnervingly mounted on the wall over his shoulder, which menacingly stared at me throughout.

All gone. I mean the mob-boss bits. The bulletproof Hummer. Even Bodog itself is mysteriously distant—licensed, he says, to independent regional operators. Ayre himself disavows any current involvement. “Bodog is the name of my boat,” he tells me with a shrug. “I honestly don’t think about it otherwise.”

He’s still Calvin Ayre, make no mistake. And he’s still conscious of projecting a badass image. So he parades down Mount Street in Mayfair looking like one of the grizzled mechanics from Discovery Channel’s Vegas Rat Rods. He enters trailing a PR person and a Filipina named Candy, who sits opposite him throughout our lunch and utters not a single word. But his eccentricities have a distinctly lighter shade. If he had one eye over his shoulder before, he’s staring into the future now. So he really doesn’t want to talk about Bodog. He really doesn’t want to talk about his 10 years on the run from the DOJ, the last five of which he essentially couldn’t travel outside Antigua or Canada.

He wants to talk about his new thing: bitcoin.

—

Ayre may be reticent about the gambling backstory, but it’s important for understanding his position within the Wild West of planet Earth’s most explosively popular virtual currency. Bitcoin is either the biggest commodity bubble in the history of financial assets, or it’s going to revolutionize global payment systems and make somebody the world’s first trillionaire along the way. Or possibly both. But whichever description you’re drawn to, you can find confirmation in bitcoin’s near vertical trend line (it trades as BTC on dedicated online exchanges). Now there’s a chart that either ends in tears or tracks the biggest gold rush we’ve ever seen.

Ayre’s stint as a target of U.S. law enforcement underpins his interest in this realm. Back in 2006, 95% of Bodog’s business was reported to be with American customers. And while he claims to have backed out of online gaming shortly after, the DOJ wasn’t going to forget the billion dollars he’d amassed while he was still in it. United States prosecutors initially indicated that he could avoid indictment if he was willing to part with $350 million in fines. Ayre declined.

“He didn’t do what he was expected to do,” says Patrick Basham, director of the Democracy Institute, a libertarian think tank based in Washington, D.C., that has spent years tracking the online gaming sector. “The point of the U.S. action was to get Ayre to throw up his hands to avoid having his life taken away.” Ayre himself explained his demurral in a 2006 magazine interview when he paraphrased Sun Tzu’s The Art of War: “I’m going to win this war without fighting battles.”

Ayre may not have wanted a fight, but the DOJ did. It indicted Ayre in 2012 on charges of operating an illegal online gambling operation that engaged in international money laundering. But the low point came shortly thereafter, when Ayre’s associates in the Philippines decided they could exploit his weakened position. Basham hinted at violence, so I probe Ayre for details at lunch.

“What was that all about in the Philippines?” I ask, as ceviche and potted shrimps, shellfish cocktails and scallops arrive.

Ayre puts down his fork and wipes his mouth with a napkin. “That was all about unscrupulous people trying to take advantage of my situation with the U.S. and steal my shit, basically.”

But what did they do? I press.

“Oh,” Ayre says, realizing I don’t know the details. He picks up his fork and starts eating with enthusiasm, talking with his mouth full. “They tried to kidnap me. A few times. But they…ah…they missed. So, lucky me! Candy, have you tried these? They’re yummy!”

Ayre was finally cleared of U.S. felony charges this summer. After 10 years of legal wrangling, it seems the government blinked. Maybe it was because Ayre really was out of gambling, as he claimed. Maybe it was the World Trade Organization rulings that repeatedly said the U.S. couldn’t go after Antiguan gambling interests, which is where Ayre was by then based. Ayre pled guilty to a single misdemeanour of being an accessory after the fact to the transmission of wagering information. The penalty was a year of unsupervised probation and a $500,000 fine. The end of the ordeal came in a conference call hosted by his lawyer in Vancouver in July 2017. But Ayre doesn’t view it as the key moment. That occurred shortly thereafter, when he arrived in London, free to cross borders without fear of being extradited for the first time in five years.

“That was cool,” he says, remembering. “Very cool.” Then he laughs. “London is the epicentre of online gaming and the epicentre of bitcoin. And that’s not a coincidence.”

—

Ayre’s bitcoin eureka moment came in 2010. He had already given up the Bodog operation, and a technology specialist working with him on a new venture (which he declines to name) presented the idea of a currency exchange for bitcoin. Ayre was only vaguely aware of the virtual currency, which had no commercial applications and negligible value at the time. But once he had the details—an international payment system involving encryption, distributed accounting, pseudonymity and no centralized control—Ayre started paying attention.

“I was like, this technology does what? Like, seriously, what?” Ayre recalls. “From the first moment I had it fully explained, I knew it was going to be huge.”

Given that Ayre was in the crosshairs of the most powerful government in the world, the fit was clearly good. After all, bitcoin is a fundamentally libertarian idea. The technology emerged from online discussions between a group of American cryptographers and a mysterious person (or possibly several people) known as Satoshi Nakamoto. Satoshi first formalized the bitcoin concept in the November 2008 white paper “Bitcoin: A Peer-to-Peer Electronic Cash System.” Then, following an online posting warning against using bitcoin to send donations to WikiLeaks, he abruptly disappeared. Speculation about Satoshi’s identity has become the digital-age equivalent of trying to uncover Deep Throat. In 2014, Newsweek famously found someone with the same name and turned his life into a circus before realizing they didn’t have their man. A couple of years later, a blustery Australian crypto-enthusiast and businessman named Craig Wright stepped forward, claiming to be Satoshi. GQ magazine hired cryptographers of their own and busted his hoax. But Satoshi’s spirit—a will to invisibility, to a perfectly preserved individual autonomy, to an absence of centralized control—informs the whole bitcoin project. And it has always appealed to people who have reason to distrust such control in the hands of government.

But Ayre was also starting to understand why others were talking about this currency like it represented a revolution. “You have to look at bitcoin as not just a payment. Payment is just the first usage,” says Shone Anstey, a Vancouver entrepreneur whose company, Blockchain Intelligence Group, designs software that law enforcement agencies use to track cryptocurrency transactions. “Bitcoin adds a trusted transaction layer to the Internet itself. It’s a very fundamental shift in the world. Once you understand it from that perspective, you start to see how big it’s going to get.”

The original motive of bitcoin’s inventors may have been to evade governments, banks and especially law enforcement, but in recent years the currency has been making inroads into mainstream consumer markets. This year saw an explosion in the number of users, which now hovers around 12 million. Today, dozens of companies offer software and hardware “wallets” to securely store the coins and exchanges on which to trade them. And companies ranging from Microsoft to spaceflight business Virgin Galactic will sell you their goods and services for bitcoins.

To appreciate the scale of this growth, consider that in mid-2010, the trading value of BTC was fractions of a penny. Users were mostly cryptographers experimenting with the protocol formalized in Satoshi’s white paper. In the most famous story from those days, Florida developer Laszlo Hanyecz paid 10,000 BTC to have a couple of pizzas delivered, just to prove that the currency could theoretically be used in commerce. A few months after Hanyecz’s experiment, BTC took off. Within a year, it was trading at $30, making those pizzas worth about $150,000 apiece. But the steepest run-up is happening this year. As of early November, the value of 10,000 BTCs stood at $70 million. That makes Satoshi Nakamoto’s reported position of one million bitcoins (his founder’s stake) worth $7 billion. No wonder people still want to find him.

This growth may exhibit “irrational exuberance,” as Alan Greenspan famously characterized the dot-com bubble of the 1990s. It has also created a problem—the same one that plagued the early Internet, when its user base went from geek specialists to commercial entities: scalability. How do you grow the thing without breaking it? If you’re old enough, you’ll remember that some developers never thought the Internet would be able to handle images. Then it was video. And on it went. But techies—often working in porn, gambling and other shady reaches of the web—devised ever new ways to accommodate user growth and the emergent demands that those users put on the system.

In bitcoin’s case, as for any cryptocurrency based on “blockchain” technology (see “Crypto cheat sheet,” below), the growth will be constrained by the system’s capacity to process transactions. The exploding user base is already slowing down the BTC exchange systems, which leads to higher costs for those who maintain the system, which leads to higher transaction fees to users. Roger Ver, a Tokyo-based entrepreneur whose early championing of bitcoin has given him cult figure–like status and the moniker “Bitcoin Jesus,” tells me that the fees have gone from fractions of a penny per BTC transaction in the early days to about $10 now. Key BTC proponents are talking about average fees reaching $100 or even $1,000 per transaction, he says.

That reality has caused a proliferation of competing cryptocurrencies such as Litecoin, Ethereum, Zcash, Dash, Ripple and Monero. Think of these nascent currencies as alternate routes that people start to seek out when the freeway becomes gridlocked. Some cryptocurrency enthusiasts—notably Calvin Ayre, Roger Ver, Craig Wright and anti-virus software pioneer John McAfee—have been voting with their feet by abandoning BTC and embracing a new currency launched on August 1 of this year. Called Bitcoin Cash (trading as BCH), it is expressly designed to speed up payment validation, lower system maintenance costs, and ultimately lower transaction costs to users. According to its proponents, BCH is a bid to get Bitcoin back to Satoshi’s original vision: fast, easy, cheap and reliable peer-to-peer transactions, with privacy for users and no central control.

Ayre grows animated as the topic of BTC scalability and the schism with BCH comes up. As the wine is poured and our mains arrive—lemon sole on the bone with sauce Bernaise, monkfish and tiger prawn masala—the judgement he renders is unequivocal.

“For Bitcoin to be successful, you need to have massive scaling, increased velocity of transactions, and low transaction fees. I firmly believe that. And so do the people we’re working with in this industry. BCH is Bitcoin. BTC might survive off in the wilderness as something else. But it’s not the real Bitcoin.”

Those appear to be more than words. In what may be the biggest gamble of his career, Ayre has pulled his cryptocurrency investments entirely out of BTC and put all that money into BCH. “You know what you should do?” he says, knife and fork in hand, getting ready to eat. “Twenty-five percent of your net assets. Put them in BCH. Don’t even let yourself look at it for a year. Then see what you have.”

So Ayre’s all in BCH. Or so he says. It’s hard to quantify his bet, since he won’t say anything about his net worth or where his money might be otherwise invested. For what it’s worth, when I ask Ver if Ayre is a big player in BCH, he laughs out loud. They’ve never met, but the first thing Ver wants me to know is that he’s honoured Ayre even knew enough about him to mention him positively in our conversation. That’s coming from Bitcoin Jesus. Then he says, “Any time a billionaire gets involved in your area, they become a big player. Yeah. Calvin’s a really big player.”

Ayre’s description of his battle plan suggests he’s moving on multiple fronts. He’s investing in fintech startups that relate to the cryptocurrency arena. He’s developing the capacity to verify BCH transactions, a process known as “mining,” and seeking cheap electricity to support the massive server farms that will require. He needs sub-5¢ a kilowatt hour, he tells me. Russia is looking promising. Ayre has also built a private commerce platform, based in Antigua, that processes cryptocurrency transactions globally both as a currency exchange and an intermediary for commercial entities.

“I’ve become one of the biggest private Bitcoin processors in the world today,” he boasts, leaning back as a waiter ghosts in to peel the skeleton out of his lemon sole in a single deft motion. “And when I say ‘private,’ that means I process only for people that I want to process.”

The last part of his plan, Ayre tells me, is become a spokesman for BCH. With the DOJ shackles off his travel, he can move around and talk to people. He’s purchased CoinGeek.com, a site devoted to cryptocurrency news, from which he can get the BCH message out. And, of course, he’s here in London eating lunch with me. “Yeah,” he says. “Part of the reason I agreed to this is that I want to work on polishing my own personal brand in the Bitcoin space. Our group needs more people like me, like Roger Ver. People willing to step forward.”

He has a habit of drumming his hands on the table to emphasize a point that particularly excites him. He does that now, either side of his plate: Badabadabada Bum!

Certainly, there is evidence of street-level excitement about BCH. Ver remains diversified, he tells me, holding a range of virtual currencies, but he now owns more BCH than BTC. Even more telling is his willingness to wager on the success of BCH, which he did recently with prominent BTC supporter Wang Chun, owner of the mining pool F2Pool. At the 2017 Shape the Future Blockchain Global Summit in Hong Kong, Chun suggested that BCH “will be short-lived.” Ver put $1 million on the table and gave Chun a two-year time frame.

Others are also stepping forward to back BCH. A couple of weeks after my lunch with Ayre at Scott’s, Craig Wright—the once would-be Satoshi Nakamoto—appeared in London to speak about cryptocurrencies at an event held in the basement of a pub. In a rambling, wine-fueled address to a room packed with more than a hundred people, mostly young men, Wright extolled the history-shifting virtues of BCH. “There is no need for a gold and silver of Bitcoin,” he said. One investment grade will do: “We only need Bitcoin Cash.”

If Ver’s wager and Wright’s zeal carry the day, then Ayre’s big gamble comes good. But it’s worth considering what might stand in the way. BTC market share has eroded with the emergence of BCH and other virtual currencies—Ver estimates that it’s down from 99% three years ago to less than 50% today—but there are still more proponents than critics of the original Bitcoin.

Shone Anstey of Blockchain Intelligence, whose software helps law enforcement agencies prevent activities such as money laundering or terrorism financing using cryptocurrencies, thinks BTC will prevail. “It has more computational power behind the network than BCH by a long shot.” More importantly, Anstey argues, BTC has reached the tipping point of broad acceptance. He reminds me of the acrimonious debates of the early internet, which also relied on an open network and architecture. “But the internet just kept motoring along and getting bigger and bigger, and eventually…there were so many users, so much momentum, that it became impossible to kill.” He believes that’s where BTC is now.

Investors choosing between BTC and BCH might do well to also consider which currency is more likely to garner the support of regulators, which are eyeing the currencies warily on both sides of the border. While cryptocurrencies in general remain inherently hostile to surveillance, such as would be required to prevent money laundering and terrorism financing, or even taxation, original Bitcoin is far safer in this regard. Anstey’s confidence in BTC is based partly on the fact that BTC transactions can be analyzed using software tools of the sort his company develops, which untangle the encryption and link individuals to suspicious transactions. Both the RCMP and U.S. Homeland Security are already clients.

BCH, in contrast, is touted precisely because it makes the tracking of suspicious activity more difficult. First, by increasing the size of the transaction blocks, the currency greatly raises the volume of data that authorities must be sift through, Ver explains. Second, with BCH’s much lower transaction fees, users can afford “mixing” services, which scramble transactions and make them harder to trace to individuals. And if these features disrupt efforts to curb money laundering and financing of terrorism, or even the national economic policies of nations, so be it. “People having more control over their money is a good thing,” says Ver. “So it’s bad that Al Qaida will have more control over their money too. But the genie is out of the bottle and there’s no putting it back.”

As our lunch draws to a close, Ayre ends up echoing Ver’s point almost exactly. He acknowledges that widespread adoption of BCH would represent a loss of centralized control, but he views that as a net gain. He brings up Russia again, as the government most likely to support the ideals of BCH and cryptocurrencies generally. “People talk about Russia shutting this thing down,” he says. “They won’t. Because it’s the one thing they have as a hedge against American control of the global financial system.”

So who invented Bitcoin? I ask. Who is Satoshi? Maybe GRU, Russia’s foreign intelligence agency?

He smiles at that, leans back. The waiters have cleared the table. Candy sits in silence, waiting for this long conversation to be over. The noise in the restaurant has been rising steadily since we arrived, all of posh London seemingly crammed into the same place at once, laughing and talking and clattering silverware. I can’t tell if Ayre had considered previously that Russia might have been behind this most recent of disruptive technologies. It wouldn’t be the first time Western libertarian impulses received support from those who used to peer at us over an Iron Curtain.

But no. He shakes his head. Satoshi was a group of people, that much is true, he tells me. To explain, he comes back his new Bitcoin commerce platform—that private service that he claims makes him one of the largest crypto-transaction processors in the world today and which he offers only to chosen clients. Like who? I ask. He leans in, lowering his voice. “Gaming sites,” he says. “Non-U.S. facing, of course. But here’s a little story I’m going to tell you.”

Satoshi: People say the big idea came out of the market crash of 2009 and the subsequent frustration with Wall Street. That wasn’t it, he says. “Bitcoin comes out of the gaming industry. The people who created it were online gaming companies responding to aggressive governments. There’s actually poker code writing in the original Bitcoin code. Did you know that? It’s there if you know where to look.”

Ayre is pleased to share this detail. There’s no way to confirm it, of course. And it certainly fits the narrative that Ayre seems eager to spin: of gaming companies as the heroes of independent enterprise, ingeniously overcoming hurdles erected by Big Government, just as Ayre himself has rounded the track, taking hurdle after hurdle, outlasting his pursuers, and ending up in a new place that can yet be seen to have emerged from the old. In orbit again around the planet Chance. Bets down. Outcome pending. A crooked smile on a gambler’s face.

Lunch is over. Ayre is on his feet. The expensive Burgundy he ordered has hardly been touched.

“We gonna take this?” he asks Candy. “We can drink it later.”

And with that, he’s off and out into Mayfair, bottle in hand.